Prepare for an SMSF shake-up in 2026

Self-managed superannuation fund (SMSF) trustees always have a lot on their to-do lists but the first few months of 2026 are likely to be busier

Self-managed superannuation fund (SMSF) trustees always have a lot on their to-do lists but the first few months of 2026 are likely to be busier

Lots of stores offer consumer leases that allow you to rent an item like a laptop, TV or fridge. How a consumer lease works A

Getting paid on time is essential for managing cash flow and establishing a profitable business. And while staying on top of unpaid invoices helps, there

If your self-managed super fund (SMSF) had assets, such as super contributions or other investments as of 30 June 2025, you’ll need to lodge a SMSF

What you can claim You can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related

There’s finally a small glimmer of good news for businesses that rely on Aussies spending on the ‘nice-to-haves’, with new data from CreditorWatch showing closures

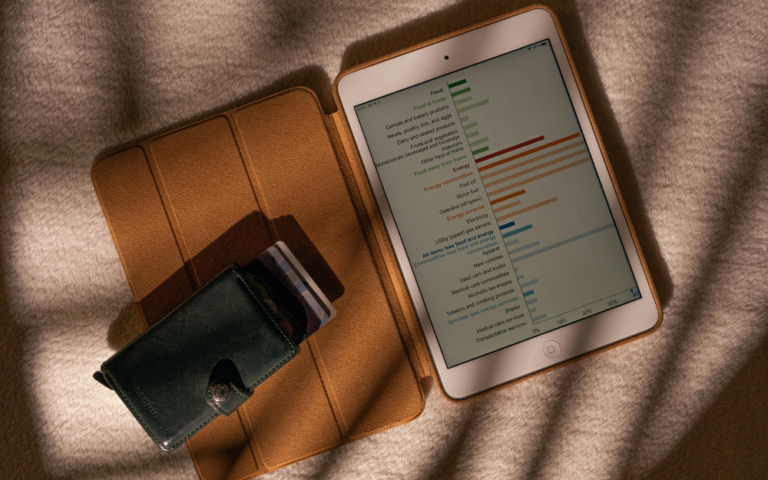

Many investors breathed a sigh of relief at having survived (and even thrived) the turbulent economic and political events of 2025. Super funds posted strong

Running a business on your own requires stamina, discipline and a level of personal responsibility few people truly understand. However, the greatest strain often sits

Last year, the world watched with interest as the Murdoch family’s real-life Succession drama came to a close. Media mogul Rupert Murdoch’s children – eyeing

The ATO has received a record 300,000 community tip-offs about tax dodgers. Here’s why doing the right thing matters. Aussies have had enough of tax

The new year is just around the corner and, while many are thinking about the holidays, a little planning now can help get your finances

After a natural disaster, you may be targeted by ‘storm’ or ‘disaster’ chasers. They might claim to offer you quicker, cheaper, or specialised repair services,